San Jose Multifamily Market Overview: Historical Trends and Market Dynamics

San Jose’s multifamily market demonstrated sustained strength throughout 2025, supported by robust rent growth, constrained new supply, and active investment activity. Even amid broader economic uncertainty, the market generally outperformed national trends, reflecting the city’s position as one of the Bay Area’s largest and most active rental markets.

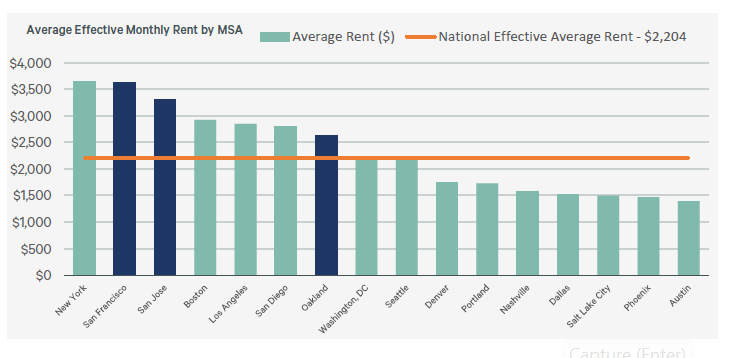

According to CoStar, San Jose posted 3.4% apartment rent growth at the end of 2025, reflecting continued strength in one of the nation’s high-demand rental markets. More recently, CoStar Senior Director of Market Analytics Nigel Hughes noted in January 2026 that the metropolitan area’s average asking rent had risen to $3,740 per month, more than double the U.S. average of approximately $1,760 (CoStar, 2026). Bay Area-wide, rents increased 4.3% YoY in 2025 (CBRE, Q4 2025). This performance reflects sustained demand supported by Silicon Valley’s higher incomes and concentrated employment base.

Recent multifamily transactions illustrate market activity. Waterton acquired the 212-unit Misora complex in Santana Row for $148 million, or over $700,000 per unit, while Ethos Real Estate purchased the 650-unit Ascent community in South San Jose for approximately $323 million. Earlier in 2025, Park Kiely sold for $370 million, marking one of the largest single multifamily transactions in the region since before the COVID-19 pandemic (CoStar, GlobeSt). These sales highlight investor interest in well-located, high-quality assets in San Jose.

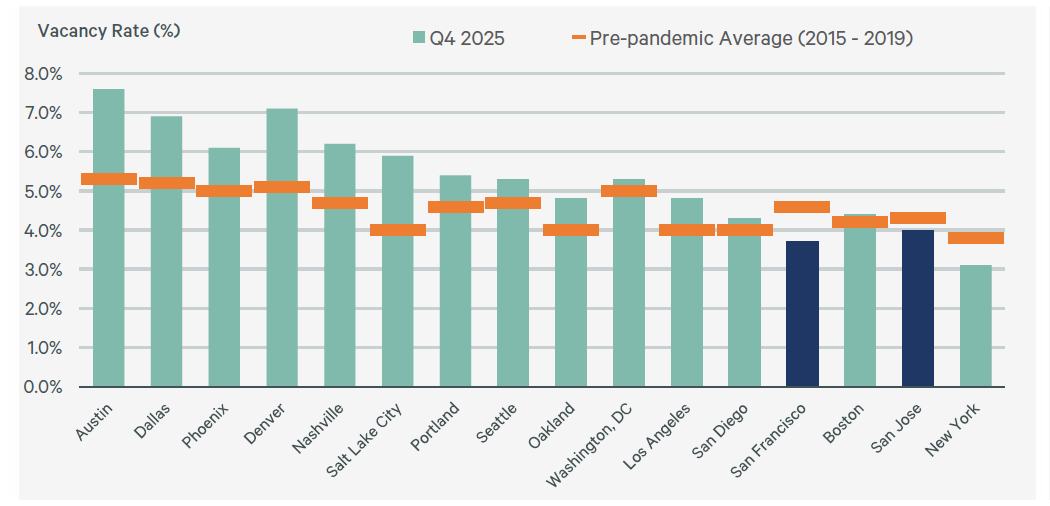

Supply constraints have been a notable factor. CoStar reports that only 2,500 units were under construction in Silicon Valley at the start of 2026, down from 7,000 at the start of 2024, reflecting persistent housing shortages despite high-income demand (CoStar, 2026). Limited deliveries, combined with strong absorption of units, have contributed to vacancy remaining below 5%.

Median household income in San Jose increased roughly 5% in 2025 to $170,000, supporting households’ ability to absorb higher rents in a market where single-family homeownership remains challenging for many. Constrained supply and continued employment growth in the technology sector, including AI-related roles, have contributed to sustained rental demand.

Bay Area multifamily sales volume exceeded $8 billion in 2025, a 9.8% increase over 2024 (CBRE, 2025). In San Jose specifically, year-to-date multifamily sales totaled $2.1 billion, with institutional and REIT investors participating in the majority of transactions (CoStar).

Historical trends and market data indicate that San Jose has maintained strong rent growth. Limited new deliveries and ongoing demand for rental housing continue to shape market fundamentals, highlighting the ongoing need for additional multifamily development in the region.

-

San Jose’s rents reached $3,190/month in Q4 2025, up 3.2% year over year, compared with the U.S. average of $1,756/month and national rent growth of 1.8%. Vacancy in San Jose tightened to 4.8%, well below the national 8.4% average.

-

Limited new construction in San Jose (only 2,427 units underway) and strong local fundamentals are sustaining demand even as many other markets see slower growth.

-

Read the full article here

-

According to CBRE Q4 2025 data, San Francisco (#1) and San Jose (#2) led all U.S. markets in rent growth.

-

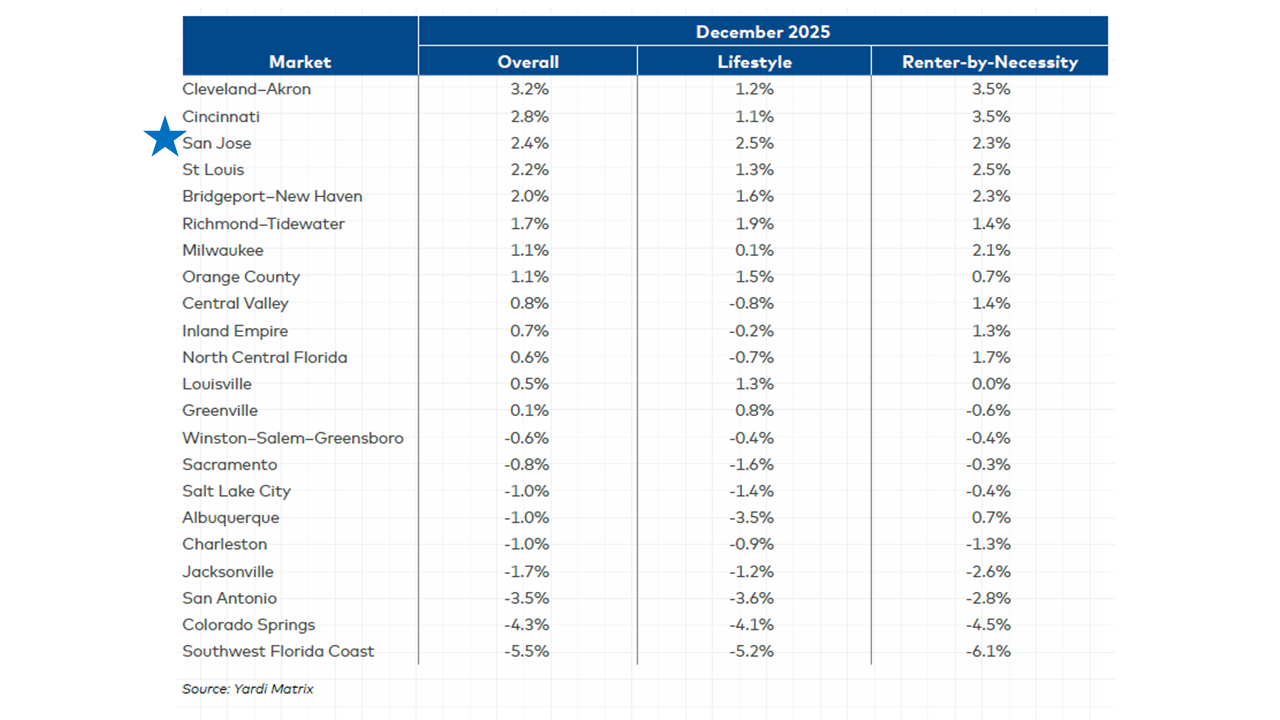

According to Yardi Matrix’s December 2025 report, San Jose posted a 2.4% year-over-year rent growth, one of the highest in the nation

-

San Jose consistently ranks among the most expensive U.S. home markets: According to SmartAsset analysis of 2025 data, San Jose was the most expensive major U.S. metro area to buy a home, with a median price of about $1,626,041

-

The sheer gap between what people need to earn to buy vs. rent is stark in San Jose; median buyers may need ~175% more income to buy than to rent a typical home, according to recent housing affordability analysis.

-

With typical home values well above $1 M and median household incomes far below what’s needed for ownership, many households find renting the only viable option in the short to medium term.

-

Where’s the toughest place to find an apartment in California? Spoiler Alert, it's Silicon Valley

-

Read the full article here

Want to learn more about our multifamily projects in Downtown San Jose?

Combined Fund Disclosures

THIS PRESENTATION IS CONFIDENTIAL. THE ACCEPTANCE AND RETENTION OF THIS PRESENTATION BY THE RECIPIENT SHALL CONSTITUTE AN AGREEMENT TO BE BOUND BY THE TERMS AND CONDITIONS SET FORTH BELOW.

THIS PRESENTATION IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY SECURITIES. THE OFFERING AND SALE OF INTERESTS IN URBAN CATALYST OPPORTUNITY ZONE FUND II LLC, URBAN CATALYST INDUSTRIAL I, UC MULTIFAMILY EQUITY I LLC, AND/OR UC MULTIFAMILY EQUITY II, LLC (COLLECTIVELY THE “OFFERINGS”) IS BEING MADE ONLY BY DELIVERY OF OFFERINGS’ PRIVATE PLACEMENT MEMORANDUMS (“PPMs”), CERTAIN ORGANIZATIONAL DOCUMENTS, SUBSCRIPTION AGREEMENTS AND CERTAIN OTHER INFORMATION TO BE MADE AVAILABLE TO INVESTORS (“OPERATIVE DOCUMENTS”) BY THE OFFERINGS’ SPONSOR(S). This material must be read in conjunction with the Operative Documents in order to fully understand all of the implications and risks of the offering of securities to which the Operative Documents relate. Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any other state securities regulator has approved or disapproved of any of the securities related to these Offerings, determined if the Operative Documents are truthful or complete or passed on or endorsed the merits of the offering. Any representation to the contrary is a criminal offense. You may only invest in the Offerings if you are an accredited investor as defined in Rule 501 of Regulation D.

An investment in one or more of the Offerings is speculative and involves substantial risks. You should purchase these securities only if you can afford a complete loss of your investment. See the section entitled “Risk Factors” of the relevant PPMs to read about the more significant risks you should consider before making an investment in any of the Offerings.

Offering Disclosure

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the relevant, confidential PPM, which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by an issuer, or any affiliate, or partner thereof ("Issuer"). All potential investors must read the PPM related to their investment and no person may invest without acknowledging receipt and complete review of the relevant PPM. With respect to any “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. All investments carry the risk of loss of some or all of the principal invested. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM for the respective offering. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment.

These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. All offerings are intended only for accredited investors unless otherwise specified.

Past performance is no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through JCC Capital Markets, LLC, a member of FINRA. Urban Catalyst and JCC Capital Markets are not affiliated companies. The information contained in this (presentation) is proprietary and strictly confidential. It is intended to be reviewed only by the party receiving it and should not be made available to any other person or entity without the written consent of Urban Catalyst.

Real Estate Risk Disclosure:

There is no guarantee that any strategy will be successful or achieve investment objectives including, among other things, profits, distributions, tax benefits, exit strategy, etc.; Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments; Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities; Potential for foreclosure – All financed real estate investments have potential for foreclosure; Illiquidity – These assets are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments. Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions; Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits Stated tax benefits – Any stated tax benefits are not guaranteed and are subject to changes in the tax code. Speak to your tax professional prior to investing.

UCME DISCLOSURES:

This confidential presentation (this “Presentation”) is being furnished upon request and on a confidential basis to a limited number of sophisticated investors on a “one-on-one” basis for the purpose of providing certain information about UC Multifamily Equity II, LLC (the “Fund”). This Presentation is for informational and discussion purposes only and is not, and may not be, relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell or a solicitation of an offer to purchase any securities of the Fund. Any such offer or solicitation shall only be made pursuant to the final confidential private placement memorandum (as amended or supplemented from time to time, and including the subscription agreement attached thereto, the “Subscription Package”) and the Fund’s limited liability company agreement, which will be furnished to qualified investors on a confidential basis at their request and should be reviewed in connection with any consideration of an investment in the Fund. No person has been authorized to make any statement concerning the Fund other than as will be set forth in the Subscription Package and any representation or information not contained therein may not be relied upon. The information contained in this Presentation must be kept strictly confidential and may not be reproduced (in whole or in part) or redistributed in any format without the express written approval of Urban Catalyst Manager V LLC (the “Manager”). By accepting this document, the recipient agrees that it will, and will cause its representatives and advisors to, use the information only to evaluate its potential interest in the Fund and for no other purpose and will not, and will cause its representatives and advisors not to, divulge any such information to any other party. Neither the Fund nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein should be relied upon as a promise or representation as to past or future performance of the Fund or any other entity. Any potential investor considering an investment in the Fund that is on behalf of an employee benefit plan or individual retirement account (or governmental, church, or foreign plan subject to laws similar to those governing employee benefit plans and individual retirement accounts) is strongly encouraged to consult with its own legal and tax advisers regarding the consequences of such an investment.

This Presentation does not constitute a part of the Subscription Package. An investment in the Fund is speculative, entails a high degree of risk, and no assurance can be given that the Fund’s investment objectives will be achieved or that investors will receive a return of their capital. In considering investment performance information contained in this Presentation, prospective investors should bear in mind that past, targeted or projected performance is not necessarily indicative of future results, and there can be no assurance that targeted or projected returns will be achieved, that the Fund will achieve comparable results or that the Fund will be able to implement its investment strategy or achieve its investment objectives. While the Manager’s projected returns are based on assumptions which the Manager believes are reasonable under the circumstances, the actual realized returns on the Manager’s unrealized investment will depend on, among other factors, the value of the asset and market conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the assumptions and circumstances on which the Manager’s projections are based. Accordingly, the actual realized returns on unrealized investments may differ materially from the Manager’s projected returns indicated herein. There can be no assurance that projected or expected realizations or distributions will occur. Furthermore, prospective investors are encouraged to contact the Manager’s representatives to discuss the procedures and methodologies used to calculate the investment returns and other information provided herein. Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of terms such as “may”, “will”, “should”, “expect”, “anticipate”, “project”, “estimate”, “intend”, “continue,” “target” or “believe” (or the negatives thereof) or other variations thereon or comparable terminology. Due to various risks and uncertainties, such as those set forth in the Subscription Package, actual events or results or actual performance of the Fund may differ materially from those reflected or contemplated in such forward-looking statements. As a result, investors should not rely on such forward-looking statements in making their investment decisions.

NOTICE TO INVESTORS

There are substantial risks associated with the federal income tax aspects of an investment in the Company. The income tax consequences of an investment in the Company are complex and recent tax legislation has made substantial revisions to the Code. Many of these changes affect the tax benefits generally associated with an investment in real estate. A further discussion of the tax aspects (including other tax risks) of an investment in the Company is set forth in the PPM under “Federal Income Tax Consequences.” Because the tax aspects of the Offering are complex, and certain of the tax consequences may differ depending on individual tax circumstances, prospective investors are urged to consult with and rely on their own tax advisor concerning the Offering’s tax aspects and their individual situation. No representation or warranty of any kind is made with respect to the Internal Revenue Service’s (the “IRS’s”) acceptance of the treatment of any item by the Company or an investor.

It is anticipated that if the Company generates taxable income, such income will be considered UBTI. Tax-exempt entities should consult with their own tax counsel regarding the effect of any UBTI. See the PPM and “Federal Income Tax Consequences – Investment by Qualified Plans, IRAs and Tax-Exempt Entities – Unrelated Business Taxable Income.”

Congress has recently enacted several major tax bills that substantially affect the tax treatment of real estate investments including, but not limited to, the tax provisions of the CARES Act. These changes will have a substantial effect on the type of activities in which the Company intends to engage, and certain of those effects are set forth under the appropriate subheadings under “Federal Income Tax Consequences.” In many instances, Congressional Committee reports have been relied upon for the interpretation and application of these new statutory provisions. While the Code authorizes the Treasury Department to issue extensive substantive regulations regarding recently adopted Code provisions, few have been issued to date. In addition, Congress could make substantial changes in the future to the income tax consequences with respect to an investment in the Company.

.jpg)

.png?width=1249&height=680&name=image%20(31).png)

.jpg)